Currently Empty: $0.00

Cash Management Using a Cash Disbursements Journal

A bookkeeper or accountant will usually record these transactions in the cash disbursements journal on a monthly basis before posting them to the general ledger, accounts payable ledger, or other books. In some businesses, the cash disbursement journal is combined with the cash receipts journal and referred to as simply the cash book. When recording cash payments to suppliers it is common cash disbursement journal example for the cash disbursement journal to include a discounts received column. By using a discounts received column, the payments journal records the invoiced amount, the discount received, and the cash payment. In this way, the line item postings to the accounts payable ledger are for the full invoiced amount, and only the discounts received column total is posted to the general ledger.

Controlled Disbursements

The accounts receivable ledger, which can also double as a customer statement, serves as a record of each customer’s charges and payments. The third transaction, company disburses $ 500 to pay for the utilities which is the expense on income statement. The journal entry is debiting utility expense $ 500 and credit cash on hand $ 500. The first transaction, the company disbursed cash of $ 5,000 to purchase the assets which is the inventory.

How long am I required to use the books of accounts? Is there a time when the BIR books of accounts are longer needed?

Another entry to petty cash is not made unless the firm wants to increase or decrease the fund above or below $100. The Specialized Journals also contain specific information that can easily be accessed for similar types of records, such as when you need to compute the VAT Input and VAT Output accounts. You will return to the first page of the form so you can add books for other branches or offices that you will add to the registration. If there are no more books you want to register for different branches, click Continue.

- Read on to get a closer look at recording cash disbursements in your books.

- The cash receipts journal manages all cash inflows of a business organization.

- It is a critical tool in the success of any business as well as making sure all information provided to the Internal Revenue Service (IRS) is correct at tax time.

- A petty cash fund is established by transferring a specified amount of cash from the general checking account to a person who is given custodial responsibility for the fund.

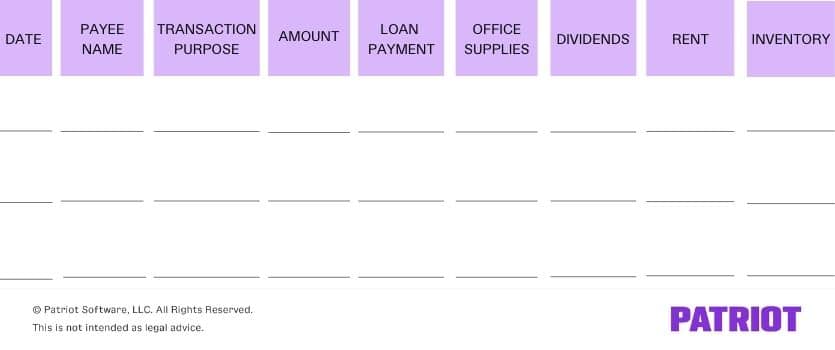

- Some critical entries in a cash payments journal include the date of transaction, payee name, description, amount paid, mode of payment, transaction ID or number, etc.

Bank runs in the age of interconnectivity: Lessons for internal auditors

In some businesses, the cash disbursements journal is combined with the cash receipts journal and is referred to as the cash book. The general ledger accounts are updated monthly using the totals from the cash disbursements journal. If a business is using subsidiary control accounts to support the general ledger accounts, the postings are part of the double entry bookkeeping system. All books dedicated to recording specific types of accounting transactions rely on the cash disbursements journal for information.

Triple-Column Cash Book

The record includes the transaction date, the amount paid, the recipient, and the payment purpose. Some critical entries in a cash payments journal include the date of transaction, payee name, description, amount paid, mode of payment, transaction ID or number, etc. The double-entry system is mostly followed where the cash account is credited, and the purchase/ payable account is debited.

Format of Cash Payment Journal or Cash Disbursement Journal

You should keep an accounts payable ledger account for each supplier. Expenses from the cash disbursements journal are, at the end of each day, posted to the appropriate accounts payable ledger. The accounts payable ledger is a record of what you owe each vendor.

The cash disbursements journal is a book of prime entry and the entries in the journal are not part of the double entry posting. A cash disbursement journal is a record kept by a company’s internal accountants that itemizes all financial expenditures a business makes before those payments are posted to the general ledger. On a monthly basis, these journals are reconciled with general ledger accounts, which are then used to create financial statements for regular accounting periods.

The entry to record the reimbursement would debit the expense accounts reported by the custodian. Because a petty cash voucher is made out for all disbursements, the total of the vouchers and the remaining cash should always equal the amount of the fund (in this case, $100). The check is cashed and the money is placed under the control of one designated individual.

Every business, small and large, needs to maintain a cash disbursement journal as it plays a critical role in keeping track of the cash flow for businesses. If a company has more cash going out than coming in, it could be a warning sign that the business is facing financial difficulties. This financial record captures essential details, including the date, payee, transaction description, amount, mode of payment, and transaction number.

Also, it will help quickly detect employee fraud or misappropriation of money. A cash disbursement journal refers to a financial record maintained by an organization’s accountants containing the details of all expenditures paid by the firm. The entries are promptly recorded before being transferred to the general ledger and used to prepare other financial statements. However, it should be replenished at the end of the accounting period in order to ensure that all expenses are properly recorded. The following example illustrates how a cash receipts journal is written and how entries from there are posted to relevant subsidiary and general ledger accounts. Your accounting software should automatically keep an accounts receivable ledger account for each customer.