Currently Empty: $0.00

Understanding Common Stock: Share Basics, Balance Sheet Impact, and Investor Insights

The drawback of common stock ownership for investors is that each stock is accompanied by operational risk related to the venture. It may be possible that the company fails in its mission or does not operate profitably. The typical process to issue common stock is known as an initial public offering (IPO). Once an IPO is complete, the common stock begins trading on the stock market.

Pocket Calculator

This difference between a low-risk expected rate of return (such as the T-Bill rate) and the higher expected rate of return that comes from increased risk is often referred to as the risk premium. If you’re interested in learning about common stock, you may also in learning about the best broker available for your needs, so visit our broker center to discover the possibilities. Our partners cannot pay us to guarantee favorable reviews of their products or services. For example, the share is issued at the cost of $100, and its par value is $20, which means you should have a minimum amount of $20 to purchase the shares. Understanding these differences underpins savvy investing, with an appreciative eye on aligning one’s risk tolerance with investment benefits.

What is the difference between Common Stock and preferred stock?

- Some prominent examples of companies that offer preferred shares include Bank of America, AT&T, and Wells Fargo.

- At Taxfyle, we connect individuals and small businesses with licensed, experienced CPAs or EAs in the US.

- Common stockholders usually have the right to vote and can take part in making business decisions.

- For this reason, share prices of preferred stocks generally don’t fluctuate as much as common stock.

- This guide will break down what common and preferred stocks are, and most importantly, provide information on how you can make an informed decision when it comes to managing your portfolio.

- Some companies choose to distribute some of the profits on their balance sheet to common stockholders in the form of dividends, and each common stockholder is entitled to a proportional share.

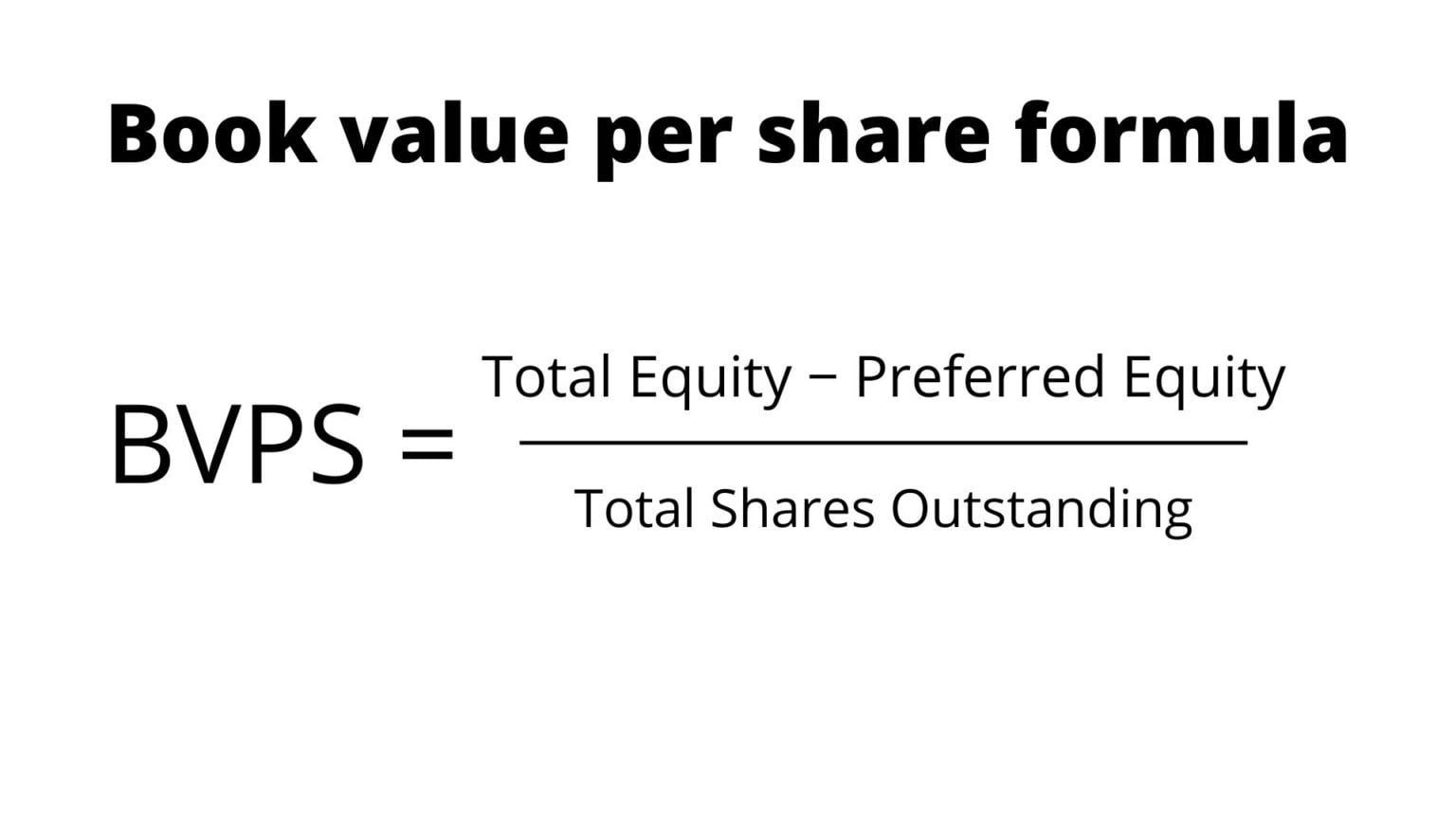

Current liabilities are debts typically due for repayment within one year, including accounts payable and taxes payable. Long-term liabilities are obligations that are due for repayment in periods longer than one year, such as bonds payable, leases, and pension obligations. Conceptually, stockholders’ equity is useful as a means of judging the funds retained within a business. If this figure is negative, it may indicate an oncoming bankruptcy for that business, particularly if there exists a large debt liability as well.

Most stocks you can buy are common stocks

There’s also preferred stock, which differs from common stock in its voting rights, dividend payment process and priority level in the case of company bankruptcy. Another important distinction between the two types of stock relates to what happens when a company is liquidated. In the investor hierarchy, preferred stockholders are paid out first before common stockholders when a company goes bust.

Treasury shares can always be reissued back to stockholders for purchase when companies need to raise more capital. If a company doesn’t wish to hang on to the shares for future financing, it can choose to retire the shares. Most ordinary common shares come with one vote per share, granting shareholders the right to vote on corporate actions, often conducted at company shareholder meeting. If you cannot attend, you can cast your vote by proxy, where a third party will vote on your behalf. The most important votes are taken on issues like the company engaging in a merger or acquisition, whom to elect to the board of directors, or whether to approve stock splits or dividends. Callable preferred stocks can be repurchased by the issuer at a preset date and price, causing you to miss out on future dividends.

Stockholders’ equity is also referred to as shareholders’ or owners’ equity. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Usually, common stock allows the shareholder to vote, but preferred stock often does not confer voting rights. The Dividend Discount Model (DDM) is instrumental in common stock valuation, especially for investors interested in predictable income streams from dividends. Let us take an arbitrary example of company A to find out how to calculate the number of outstanding shares of the company. We will also try to understand what authorized shares, issued shares, and treasury stocks mean. For example, suppose the number of authorized shares for a company is 5000 shares. Depending on the business performance, the value of shares go up or down.

It is usually listed as a separate line item along with any other stock the company may have issued, such as preferred stock. On the balance sheet, the dollar value of common stock shows the par value of each share, which is the nominal or face value set by the company at the time the 11 sample business plans to help you write your own shares were issued. Preferred Stocks– When a person invests in the Preferred stocks, he or she is preferred over common stock investors in terms of getting dividends from the company. The downside of the preferred stock is that preferred stockholders do not have a right to vote.